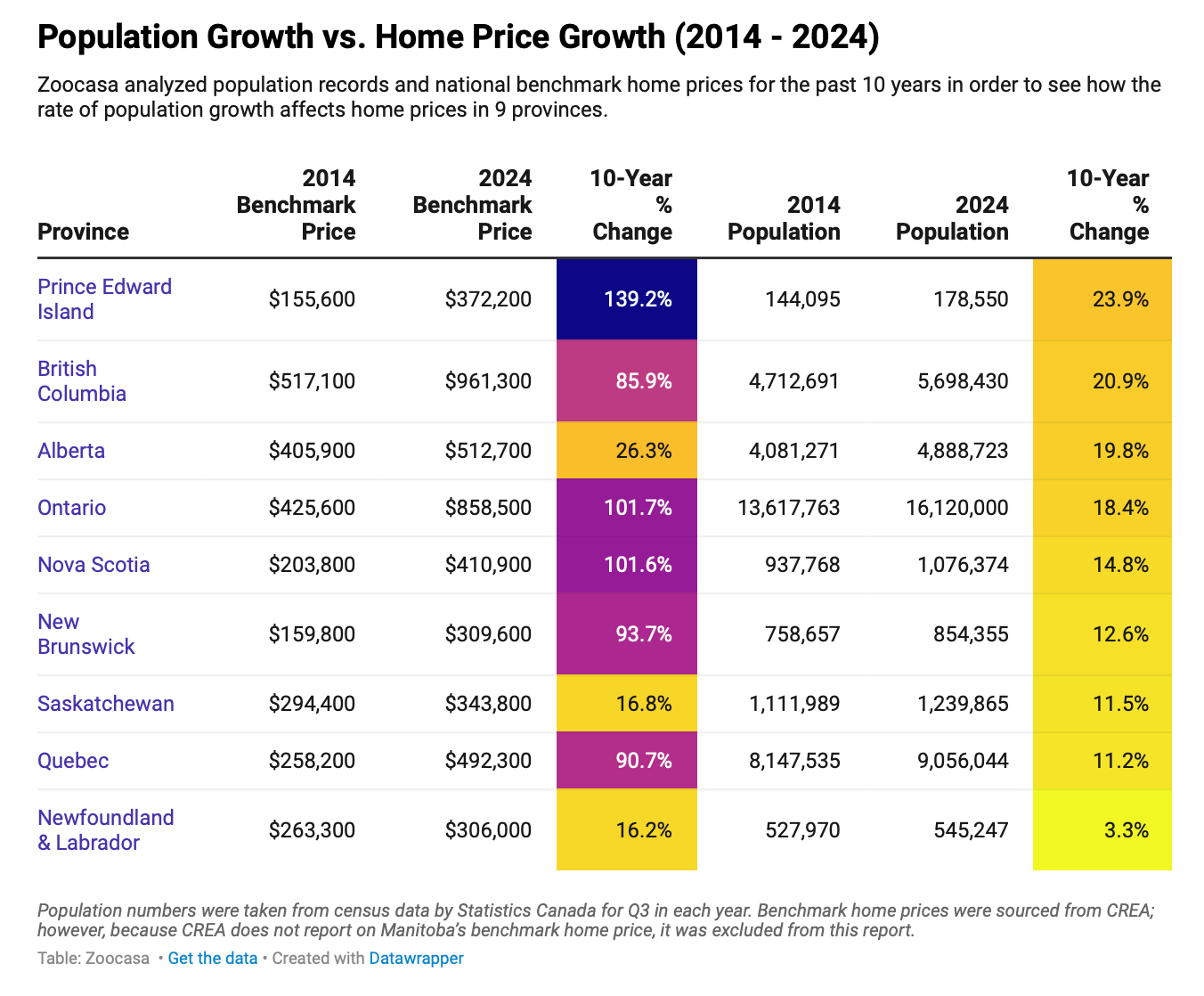

Canada's population reached 41 million in 2023, surpassing the 40-million milestone and projected to hit 62.8 million by 2073. This growth, however, is uneven across provinces, driven by international immigration, temporary residents, and interprovincial migration, all boosting housing demand and prices. In response, the Canadian government plans to cut permanent resident intake by 21% in 2025-26.A Zoocasa analysis shows that home price growth from 2014 to 2024 significantly outpaced population increases across nine provinces, suggesting other factors like interest rates, supply, demand, and economic policies are also driving prices. For example, Prince Edward Island saw the largest growth in both population (23.9%) and benchmark home prices, which doubled to $372,200. British Columbia and Ontario also saw major increases. By contrast, Newfoundland & Labrador and Saskatchewan had modest growth in both population and home prices.

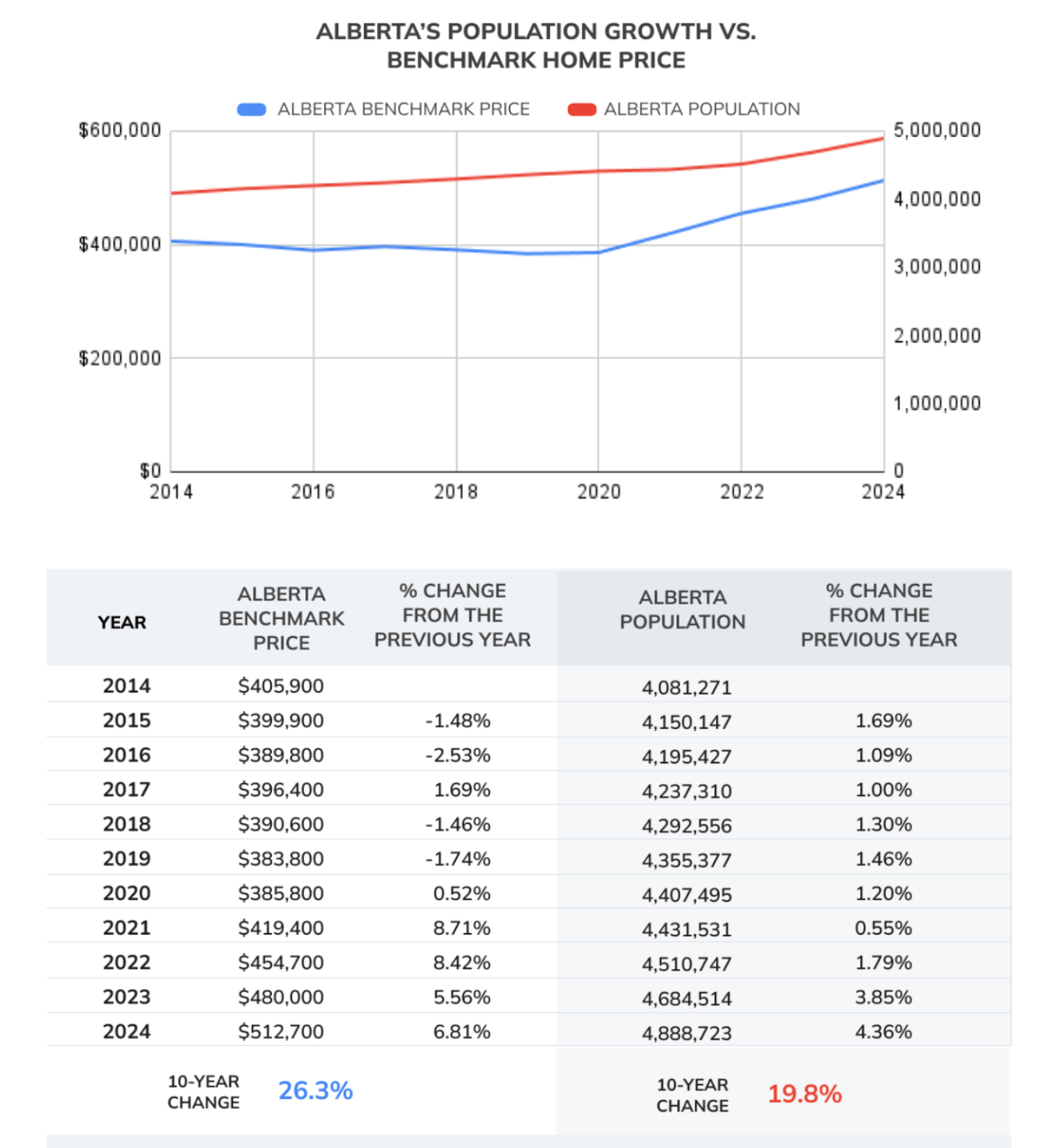

Alberta’s population growth surged by 4.4% from Q3 2023 to Q4 2024, leading the country. Despite a 19.8% population rise since 2014, Alberta’s benchmark home prices have only climbed 26.3%—one of the smallest increases among provinces. This modest price growth is partly because Alberta’s population growth remained below 1.5% annually from 2014 to 2021, only accelerating in 2022.In comparison, British Columbia and Ontario saw consistent population growth over 1.75% in several years, which contributed to higher housing demand. Alberta’s affordability has attracted many, yet rapid growth is now impacting housing costs; from September 2023 to September 2024, its benchmark price jumped by 6.81%, the highest provincial increase. With just one new housing start for every 4.1 residents in Q4 2023, Alberta’s supply lags demand, potentially driving prices higher if trends persist, possibly surpassing $600,000 by 2027. Read fulll article here Zoocasa

Disclaimer:

The information provided in this blog is for general informational purposes only. It is not intended to serve as legal, financial, or professional advice. The content should not be relied upon as a substitute for seeking appropriate legal, financial, or real estate guidance. Readers are encouraged to consult with qualified professionals before making any decisions based on the information provided in these posts, including those accessed through hyperlinks.

The information provided in this blog is for general informational purposes only. It is not intended to serve as legal, financial, or professional advice. The content should not be relied upon as a substitute for seeking appropriate legal, financial, or real estate guidance. Readers are encouraged to consult with qualified professionals before making any decisions based on the information provided in these posts, including those accessed through hyperlinks.